Focused on Factoring

We specialize exclusively in factoring systems, offering a tailored solution rather than a one-size-fits-all approach. Every step is meticulously crafted to meet your specific needs.

Discover More

— your fast track to truly online factoring

An accounting system with personal accounts for suppliers and debtors, featuring KYC, limits, invoice verification, API, and over 15 roles to automate every stage.

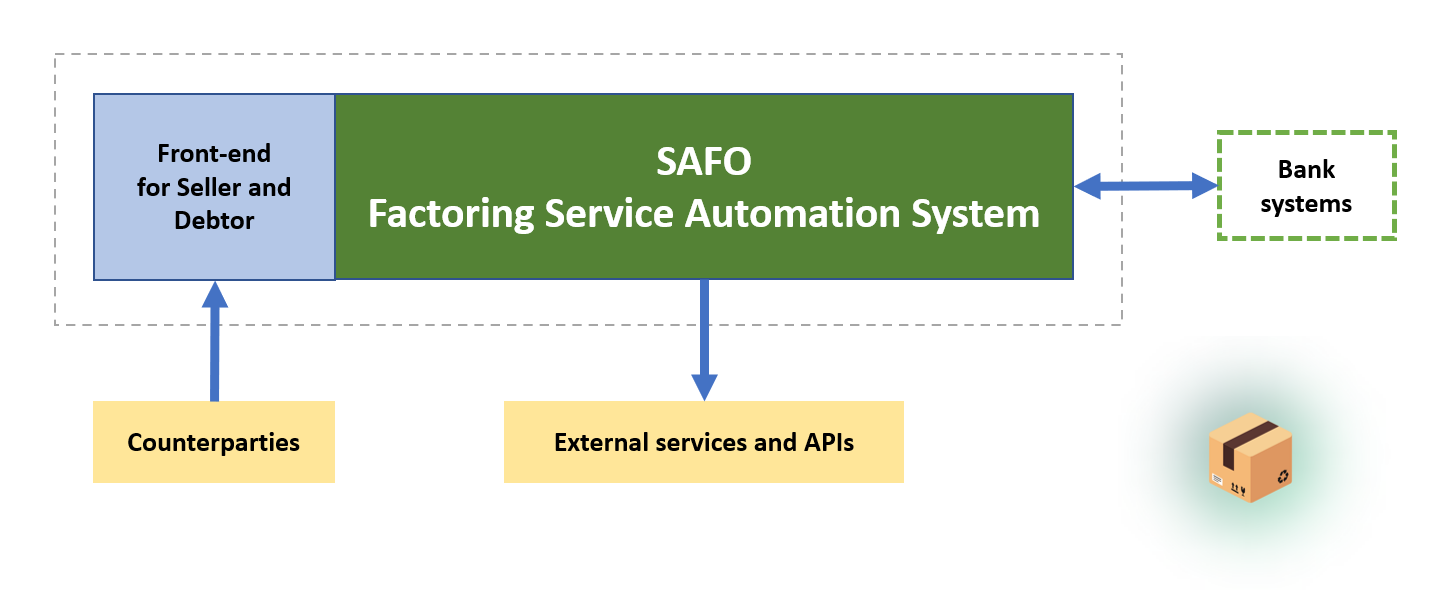

FactorBox is a comprehensive IT solution for factoring companies. It includes a front-end and back-end system, an AI operator, and a detailed access and role model for all stakeholders in the factoring process.

| Category | Description |

|---|---|

| Location of Parties | Domestic: The supplier, debtor, and bank are all located within the same country. |

| Participant Awareness | Disclosed Factoring: The debtor is notified. Confidential Factoring: The debtor is not notified. |

| Timing of Financing | Advance (Prepayment): An advance ranging from 1% to 100% of the transaction amount is provided at the time of the deal, minus a discount. Fixed Maturity Factoring: Payment is made on a specified date, either on demand or after a set number of days (maturity period). Financing after the deferral period. |

| Recourse Availability | With Recourse: Factoring with recourse. Without Recourse: Non-recourse factoring. |

| Type of Factor | Bank and Non-bank factors. |

| Commission Payer | Supplier: From the financing amount, from the second payment, or based on invoices. Debtor: Based on invoices. Shared Commissions: Between participants. |

| Beneficiary | Supplier Factoring: Traditional factoring. Reverse Factoring: The buyer assumes the credit risk and the obligation to pay the factor's fee. Confirming: Financing the supplier for 100% of the delivery amount upon acceptance of goods by the buyer. |

| Unlock New Opportunities for You | With a modern Microsoft technology stack, nearly 15 years of experience in industrial factoring automation, and complete control over the code, we can expand and tailor the system's capabilities to meet your specific needs. |